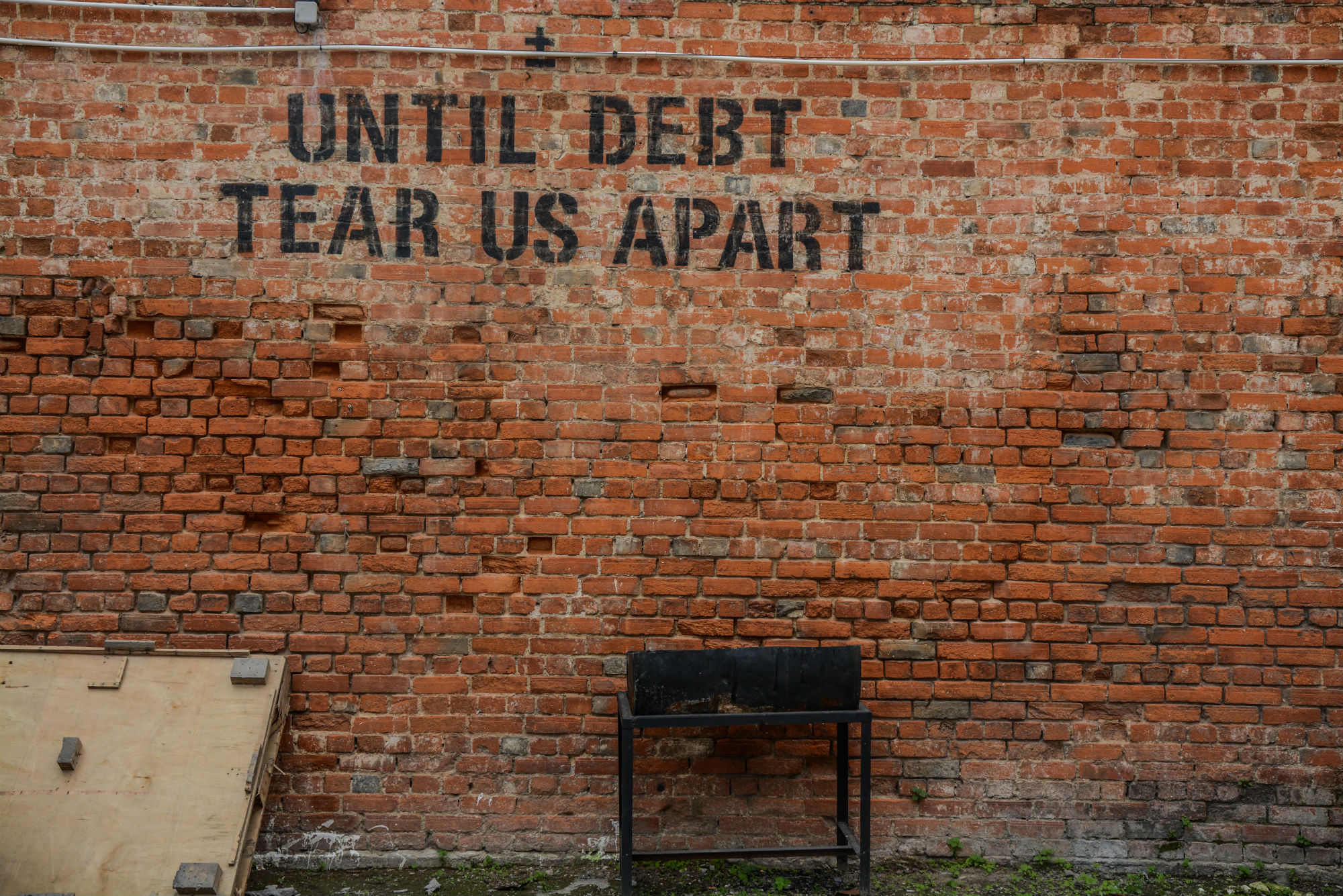

Financial abuse: spot the signs during lockdown

Financial abuse is a form of domestic abuse and it's a very real problem in our society. As UK lockdown continues, these are the signs someone is suffering and needs help

Financial abuse is a form of domestic abuse and it's a very real problem in our society. As UK lockdown continues, these are the signs someone is suffering and needs help

Sadly, we know that for many people home is not a place of safety, but rather a place where they may face increased control, abuse and isolation. We understand domestic abuse to be a pattern of incidents of controlling, coercive, threatening, degrading and violent behaviour - but recognising the signs of financial abuse is less common.

Financial abuse is a form of domestic abuse, and it is characterised in relationships by controlling a person’s ability to acquire, use and maintain their own money and financial resources. With the UK still under lockdown, these patterns of behaviour are more prevalent, and so banking company NatWest has joined forces with SafeLives, the UK-wide charity dedicated to ending domestic abuse, to try and help highlight the signs that someone may be experiencing financial abuse.

Kim Chambers, Customer Protection Adviser at NatWest, told us, 'Financial abuse can be hard to spot and can be devastating for victims who are isolated or vulnerable. We urge anybody experiencing the signs of financial abuse we have laid out to get in touch for a safe, secure and confidential conversation with our one of our specialists.'

NatWest is working to ensure that vulnerable customers are protected at this challenging time. Customers can:

- Report their circumstances using our secure online form

- Conduct secure confidential conversations with our dedicated Financial Abuse Specialist at a safe time for them

- Access existing support services including online banking and mobile app access as well as the ability to open a new account with a different sort code to hide a survivor’s location after they leave

During this uncertain time, NatWest is encouraging us all to look out for people who:

Have unusually restricted access to finances

As people are home together, an abuser might have greater oversight of spending. Abusers may also use the instability of the current situation to take even greater control of finances. Many people are concerned about their finances at the moment, but someone experiencing financial abuse might express particularly heightened distress about a change in their personal or household income

Celebrity news, beauty, fashion advice, and fascinating features, delivered straight to your inbox!

Cannot access financial support

Look out for someone who says that their partner is preventing them from speaking to their mortgage provider, utility company or another contract provider to negotiate a payment holiday or other form of financial support available during COVID-19.

Are struggling to work from home

Abusers may use the lockdown to interfere with someone’s ability to work by insisting that they are responsible for childcare, or to deny someone the equipment they need such as a laptop. They may be carrying out additional paid or unpaid work and/or caring responsibilities with no help from their partner, for example providing food packages for their family or being forced to disinfect the home regularly.

Are not staying socially connected

An abuser may use current isolation measures to cut someone off further from sources of support. If someone you care about is in touch less frequently, this may be a sign that an abuser is limiting their contact with others. Also look out for a change in their usual tone if you are in contact by phone.

Prioritising buying items or paying bills that may not seem essential

Someone experiencing financial abuse might prioritise a particular bill to meet the demands of the abuser, who may be spending more time at home. For example, they may need to pay for extra mobile phone data over a water bill. They may also buy expensive items that don’t seem essential, such as new technology for the home, to meet the abuser’s demands.

* If you want to know more about the signs and impact of economic abuse visit Survivingeconomicabuse.org

* If you, or someone you know is experiencing domestic abuse, contact the National Domestic Abuse Helpline, run by Refuge on freephone 0808 2000 247. Lines are open 24/7.

Olivia – who rebranded as Liv a few years ago – is a freelance digital writer at Marie Claire UK. She recently swapped guaranteed sunshine and a tax-free salary in Dubai for London’s constant cloud and overpriced public transport. During her time in the Middle East, Olivia worked for international titles including Cosmopolitan, HELLO! and Grazia. She transitioned from celebrity weekly magazine new! in London, where she worked as the publication’s Fitness & Food editor. Unsurprisingly, she likes fitness and food, and also enjoys hoarding beauty products and recycling.